Section 1231 property is a powerful IRS classification for real or depreciable business assets held longer than one year, offering businesses a rare tax advantage: net gains are taxed at lower capital gains rates, while net losses are deductible as ordinary income. This “tax superhero” status applies to assets like buildings, machinery, livestock, timber, and even unharvested crops, making it a cornerstone of strategic tax planning for entrepreneurs, farmers, and real estate investors. In this guide, we’ll break down how Section 1231 works, which assets qualify, and how to leverage its rules to minimize your tax bill while maximizing deductions. Keywords like Section 1231 gains, depreciable business property, capital gains tax, and ordinary loss deductions will help you navigate this tax code gem.

What Is Section 1231 Property?

Section 1231 of the IRS code governs the tax treatment of long-term business assets (held >1 year) that are either:

- Real property (land, buildings).

- Depreciable assets (machinery, vehicles, equipment).

- Natural resources (timber, coal, livestock).

Unlike regular capital assets, Section 1231 lets businesses:

- Treat net gains as long-term capital gains (taxed at 0%, 15%, or 20%).

- Treat net losses as ordinary losses (100% deductible against income).

How Section 1231 Works: The “Best of Both Worlds”

Step 1: Net Gains vs. Losses

At tax time, combine all Section 1231 transactions for the year:

- Gains: Sales of qualifying assets for more than their adjusted basis.

- Losses: Sales of assets for less than their adjusted basis.

Example:

- Sold a warehouse (held 5 years) for a $50,000 gain.

- Sold old farm equipment (held 3 years) for a $10,000 loss.

- Net Section 1231 gain = $40,000 → taxed as capital gains.

If losses exceed gains, the net loss deducts dollar-for-dollar from ordinary income.

Key Assets That Qualify

| Asset Type | Examples | Holding Period |

|---|---|---|

| Real Property | Office buildings, rental properties | >1 year |

| Depreciable Assets | Tractors, computers, manufacturing tools | >1 year |

| Livestock | Cattle, horses (dairy/breeding) | >2 years |

| Natural Resources | Timber, coal, unharvested crops | >1 year |

Exclusions: Inventory, patents, poultry, and personal-use assets.

Tax Treatment: Gains vs. Losses

Gains: Capital Rates (Mostly)

- Net Section 1231 gains are taxed as long-term capital gains.

- Exception: The lookback rule recaptures gains as ordinary income if you claimed ordinary losses in the past 5 years.

Losses: Full Ordinary Deductions

- Net Section 1231 losses reduce ordinary income (e.g., wages, business revenue).

- No $3,000 annual limit like capital losses.

Real-World Example: Farm Equipment Sale

Barclay owns a farm and sells:

- Tractor: Bought for $80,000, sold for $100,000 after 3 years → $20,000 gain.

- Barn: Bought for $200,000, sold for $150,000 after 10 years → $50,000 loss.

Result:

- Net Section 1231 loss = $30,000.

- Barclay deducts $30,000 as an ordinary loss, reducing taxable income.

Reporting Section 1231 Gains/Losses

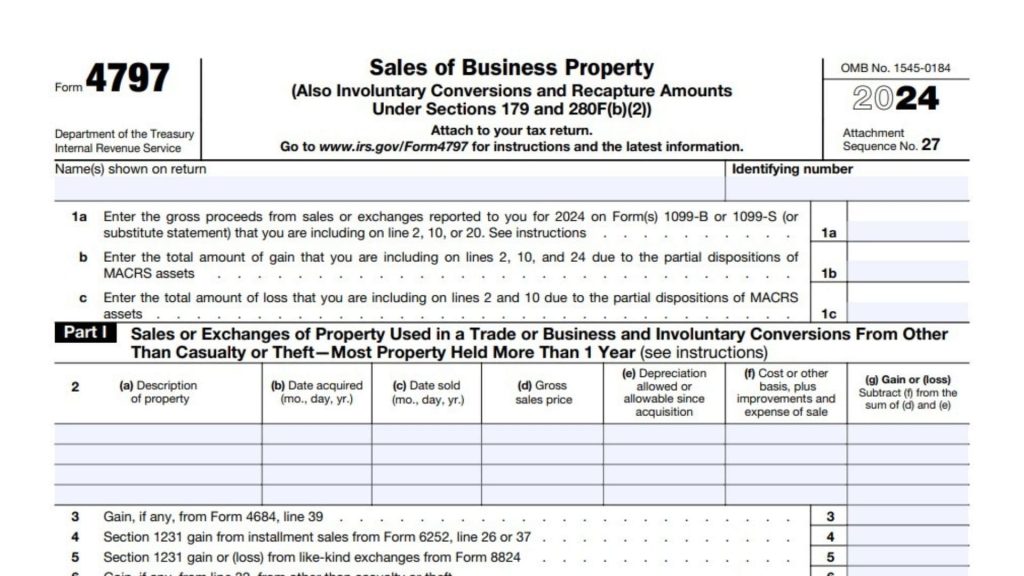

Use IRS Form 4797 to report sales of business property:

- Part I: Ordinary gains/losses (e.g., inventory).

- Part III: Section 1231 transactions.

- Part II: Depreciation recapture (taxed as ordinary income).

Benefits of Section 1231 Property

- Tax Flexibility: Profit? Pay lower rates. Lose? Deduct fully.

- Encourages Long-Term Investment: Rewards holding assets >1 year.

- Farm & Timber Perks: Special rules for agriculture and natural resources.

FAQs

Q: Can I claim Section 1231 losses on rental properties?

A: Yes! Rental real estate held >1 year qualifies. Losses deduct against ordinary income.

Q: How does the lookback rule work?

A: If you claimed Section 1231 losses in the past 5 years, current gains may be taxed as ordinary income.

Q: Is livestock always Section 1231 property?

A: Only if held for breeding/dairy >2 years (cattle/horses) or >1 year (other livestock).